Curated Alpha for Traders

Get the latest news and analysis on Bitcoin mining and hashprice trading in your inbox every other week. No spam. Unsubscribe anytime.

BLOG

Get the latest news and analysis on Bitcoin mining and hashprice trading in your inbox every other week. No spam. Unsubscribe anytime.

Navigating the complex landscape of Bitcoin mining requires not only cutting-edge technology but also an acute understanding of market dynamics. Among the critical tools at the disposal of the Bitcoin mining industry are Luxor's Hashrate Forwards. This post explores the historical data of the Hashrate Forward Curve to assess its efficacy in predicting future hashprices and to identify potential opportunities for extracting alpha.

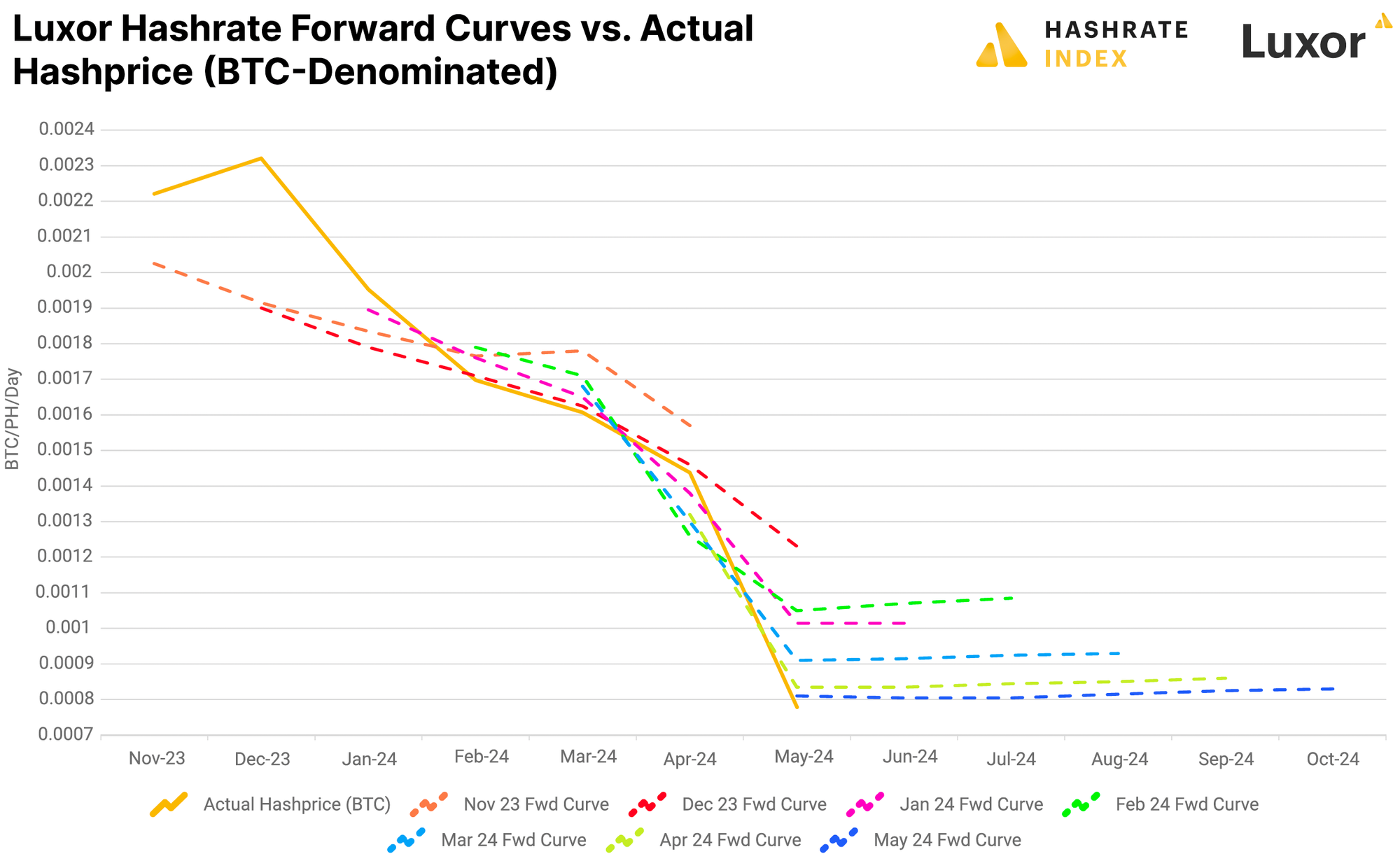

The chart below shows the BTC-denominated curve for Luxor Hashrate Forwards contracts from November 2023 to May 2024. We derive this forward curve by taking an average of the highest bid and lowest ask on Luxor’s Hashrate Forward order book on the first trading day of each calendar month for each Forward contract month. For example, for the November data point, we take the bid-ask average for forward contracts on the first day of November for November, December, January, February, March, and April forward contracts. We then compare these forward prices to actual monthly average spot hashprices.

As the chart demonstrates, Luxor Hashrate Forward market participants have been generally accurate at pricing future hashprice. We may expect this given that BTC-denominated hashprice is more static than USD-denominated, because the only variables traders have to account for are changes to mining difficulty and transaction fees. But the latter is where the alpha lies.

For instance, we see actual hashprice (the solid yellow line) rise sharply above forward pricing in November, December and January. In USD terms, transaction fees were at their highest levels since 2017 for these months thanks to inscriptions trading, and fees stayed elevated for the longest period since 2020/2021’s bull market. As a result, hashprice surged during this period.

As such, forward buyers for these months made a pretty penny. Conversely, though, buyers were overconfident that the transaction fee gold rush would last longer than it did, so traders overbid for hashprice in February and March. As such, miners and hashrate sellers who locked in forward prices for these months earned more than they would have if they had mined spot hashprice.

Currently, hashrate forwards are trading in contango over the next six months. Bitcoin’s difficulty will be a decisive factor for future hashprice trajectory obviously, but as the above chart suggests, transaction fees will likely have more of an impact.

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Do you have any questions?

Please contact our support team