Curated Alpha for Traders

Get the latest news and analysis on Bitcoin mining and hashprice trading in your inbox every other week. No spam. Unsubscribe anytime.

BLOG

Get the latest news and analysis on Bitcoin mining and hashprice trading in your inbox every other week. No spam. Unsubscribe anytime.

Hedging is a relatively new concept in the Bitcoin mining industry. Until recently, Bitcoin miners were unable to hedge their hashrate production and consequently their revenue. But that’s all changed with Luxor’s Hashrate Forwards. Miners now have access to a suite of hedging instruments to de-risk, optimize and grow their operations.

However, a key question remains: how much hashrate production should a Bitcoin mining company hedge? In today’s post, we explore that question.

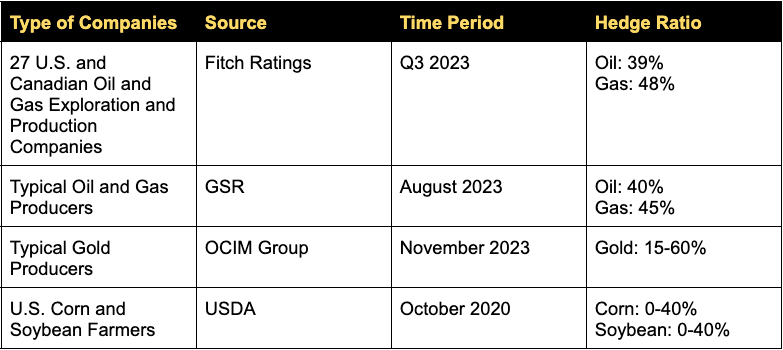

The obvious first question to ask is: how much do producers of other commodities hedge their revenue? The table below shows hedge ratio estimates for different commodity producers from a range of sources:

Much like any other corporate activity, hedging is intended to support a company’s overall goals and objectives. Typically, commodity producers hedge their production to reduce price risk and obtain revenue certainty. Commodity producers are experts in production and operations, not necessarily in speculative trading or forecasting market variables into the future. Hedging allows commodity producers to focus on core operational competencies and minimize risks.

Several benefits accrue to companies who hedge, namely lower volatility and higher certainty in cash flows. In general, these two factors increase valuation metrics and access to financing by reducing the cost of capital. Most importantly, companies who hedge obtain downside protection which can help them survive bear markets.

However, there are reasons for commodity producers choosing not to hedge their production.

Perhaps the producer wants exposure to the price and revenue volatility. This could be the case if a company has information to suggest future prices will be higher than market expectations, or if the producer is already unprofitable and trying to gamble their way out of financial distress.

A commodity producer may also decide not to hedge if their business operations already provide a natural hedge. For example, if a commodity’s price fluctuates predictably with its costs, a company that does not hedge will already have profit margin certainty. This is not the case for Bitcoin miners.

Some argue that shareholders can hedge and diversify their investments themselves. This may be the case, but typically it is more cost efficient for a company to hedge instead of each individual investor, many of which do not have access to appropriate hedging instruments.

A Bitcoin miner’s hedging decision will depend on several economic factors such as risk tolerance, hashrate market outlook, hashprice volatility, as well as their operational costs and financial health. Hashrate producers with lower risk tolerance, higher production costs, and substantial debt burdens should consider a higher hedging ratio compared to those with higher risk tolerance, lower costs, and minimal debt. Periods of high volatility in hashprice may also motivate miners to hedge, in an effort to lock in revenue and avoid the uncertainty associated with constituent factors such as Bitcoin price, network difficulty, and transaction fees.

Bitcoin mining companies may avoid hedging because of the challenges associated with explaining a hedge in a situation where there is a loss on the hedge (i.e., the hashrate forward contract) and a gain on the underlying (i.e., exposure to spot hashprice). Executives and shareholders may not recognize that hedging is typically a cost of business rather than a revenue generation method, putting pressure on the finance department for having to justify logical hedging decisions in hindsight. Indeed, hedging is a risk management tool for buying certainty and obtaining more predictable cash flows. Since hedging reduces volatility, it inevitably yields better or worse results versus spot hashprice exposure at certain points in time. If finance teams fear blame for unfavorable outcomes when hedged, they may opt to remain exposed to spot hashprice and instead leave market conditions to take the blame — a frequent and costly mistake.

To illustrate the benefits of hedging, we present below a simple example of how a Bitcoin miner may manage risk by covering its electricity bill liability against a certain decline in hashprice through our Bitcoin Mining Hedge Calculator.

In this scenario, a 100 PH/s mining operation with 500 Antminer S21 units pays $0.055 per kWh for electricity. To secure funds for electricity costs and protect against hashprice fluctuations, the miner hedges part of its production by entering a 30-day hashrate forward contract. This involves selling its hashrate at a fixed rate of $42 per PH/s/day for the upcoming month.

Looking at the cell in the bottom-left corner of the Hashprice Scenarios table, we can observe that this miner hedging 10% of its production obtains downside protection against a 50% drop in spot hashprice, since its overall profit will be zero as the loss in mining revenue is offset by a corresponding gain in the forward contract. This example demonstrates the fact that a little bit of hedging can go a long way in providing risk management against volatility in hashprice.

Please note: this example is strictly for demonstration purposes and based on simplifying assumptions mentioned above; it excludes fees and bid/ask spreads associated with entering into hashrate forward contracts.

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

Do you have any questions?

Please contact our support team