Luxor’s 2024 Year in Review: Always be Shipping

Happy New Year to all of our business partners and industry companions;

Closing out 2024, we took some time to reflect on Luxor’s remarkable growth and evolution. It’s been just over 7 years since we incorporated the company, 5 years since we went full-time and 4 years since we hired our first non-founder employees. It has been an incredible journey! We are excited about our progress this year in unifying our products into one simplified platform for miners to acquire machines, optimize their performance through LuxOS, get paid through the mining pool and hedge their future revenue with derivatives. As always, we are grateful to our partners who have helped us get to this point.

Over the course of the year, we’ve seen:

- Luxor's headcount expanded from 58 to 80, working across 15 different countries

- Over 3,200 unique clients/users across our core product lines

- Over 1.5M views on Hashrate Index website, content, and data pages

- LuxOS Firmware hashrate increased from 3.0 EH/s to 13.7 EH/s

- Luxor BTC Pool hashrate rose from 16.9 EH/s to 24.1 EH/s

- ASIC Desk average daily trading volume increased from $0.5M to $1.2M

- Derivatives total USD notional value traded up from $10M to $65M

Now, let’s have a deeper look at Luxor’s 2024.

Unified Platform for Miners

Shortly after launching our first mining pools more than five years ago, we began to whiteboard what additional software and services we could build for the mining industry. Following a series of unique pool features, we launched the ASIC brokerage in 2021, followed by firmware and derivatives in the following years. Fast forward to 2024, and each of these product lines has found great product-market fit, being used by thousands of companies globally. In Q4’24, it became clear we needed to bring a unified experience to all of the applications our users interact with on a daily basis. We are closer than ever to completely unifying these products in a single dashboard ecosystem for users, greatly augmenting the experience of using the entire Luxor product suite. We have already begun rolling out the new Luxor experience to select customers and will begin the full migration process early in 2025.

LuxOS Is The Standard

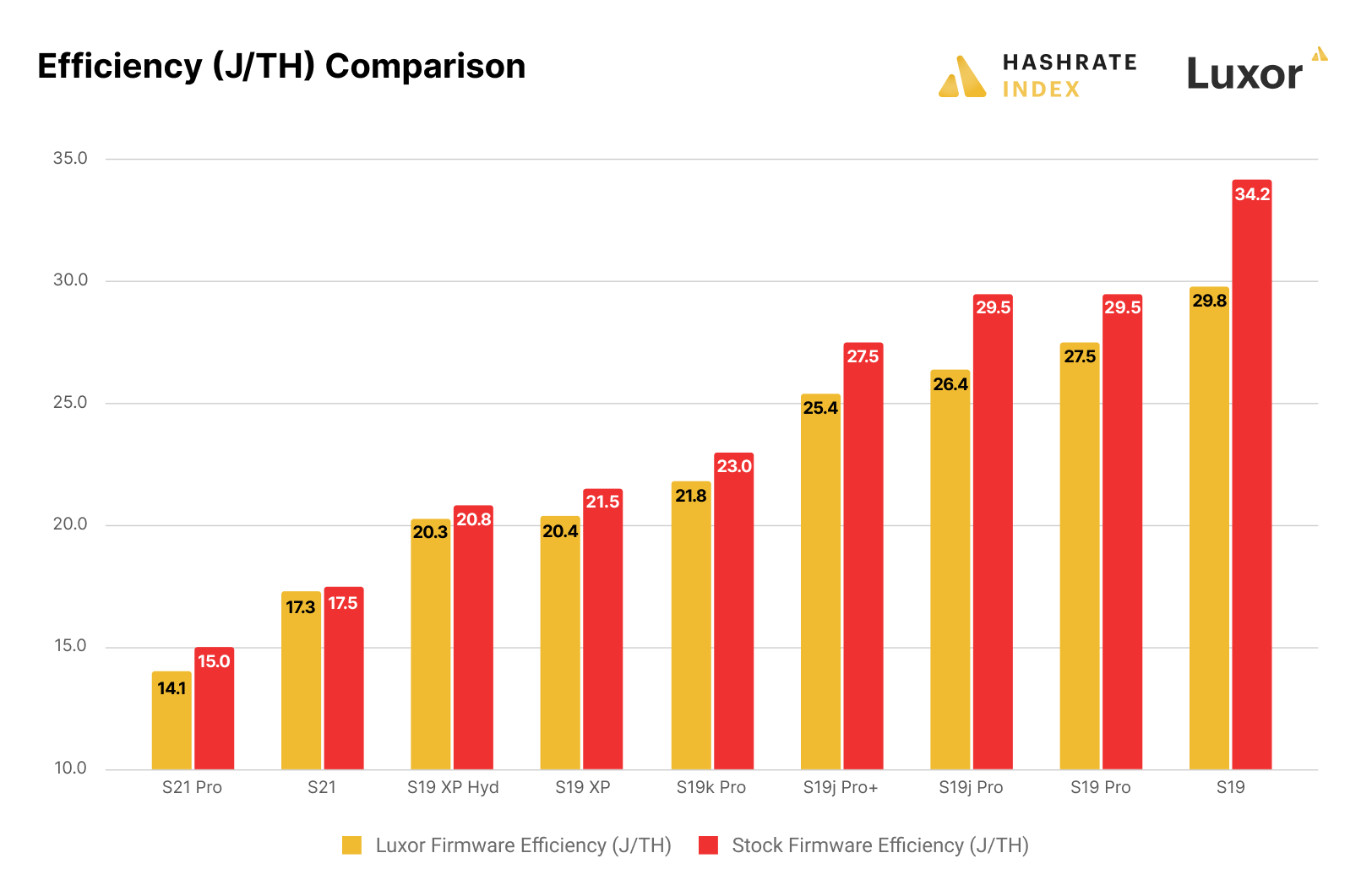

Existing firmware products have scratched the surface of what is possible within a mining farm and at the machine level. Our embedded engineering team has been busy coordinating with our business team to understand the novel ways we can improve mining operations and propel Bitcoin miners to vastly superior economic returns and machine longevity.

Our team has been heads-down building features and improving the already industry-leading performance of LuxOS. At the center of this effort is our work on the auto-tuner, which we believe is the market lead when looking at efficiency gains. In addition, we added support for 20 new models and are constantly working on adding additional support across multiple manufacturers – our ultimate goal being that any mining operation, no matter the hardware mix, can be handled by one solution with LuxOS. In parallel to these product efforts, we went through the rigorous process of obtaining our SOC2 (Type II) certification for LuxOS and believe we are now the most secure and reliable after-market firmware in the industry. We work with our clients’ financial auditors directly to help them with the audit process and any financial reporting considerations.

There’s no better testament to the quality of our product than the rapid growth we have seen in our firmware users. Our hashrate grew by 350% YoY and we ended the year with 1100+ clients utilizing LuxOS to maximize their operations.

The Pursuit of Consistent ASIC Liquidity

In ASIC Trading, the name of the game is liquidity. We know many people have interacted with a traditional OTC desk and the Luxor ASIC Trading desk should have a very similar experience. When a miner or investor comes to our desk to buy or sell hardware, we always strive to provide a quote to transact. Our goal is to be able to transact close to the market clearing price, at scale, and execute quickly. Our desk has done a great job at executing on these goals, highlighted by an average daily trading volume of $1.2M and over 800+ deals in 2024 with 200+ unique clients. The trajectory is exceedingly optimistic and we are expecting to vastly surpass these numbers in 2025.

In order to continue growing our liquidity, we have pursued new forms of partnerships with the manufacturers for both spot and future machine deals. For example, we signed a $131.4mm deal with MicroBT to secure the best-priced machines for our clients and partners. We continue to work closely with major manufacturers such as Bitmain and Canaan as well. In addition, we are cross-structuring deals with our derivatives desk to help miners expand without having to dilute shareholders or pay above-market interest rates; a recent publicly available example is the deal with Bitmine, where a hashrate forward sale was used to acquire ASICs through our desk.

The ASIC Market is always dynamic and we witnessed some interesting trends in 2024 that we continue to strategically position on. The leading manufacturers Bitmain, MicroBT, and Canaan have been pivoting a lot of focus to development on immersion and hydro cooling units. New entrants Block and Bitdeer aim to shake up the industry with their new machines. A possible resurgence of tariffs looms large as we head into a new Trump administration in the US. We are excited to see what the future holds and feel we will be the best positioned ASIC Trading desk in the industry to respond to the ever changing market dynamics.

Alongside our hardware business, our shipping and logistics product line has received great feedback from clients. We have been able to provide seamless shipping experiences with very little input and hassle required from our clients. The team has built deep expertise in this business: from extra details on packaging ASICs, to delivery to off-grid sites, to navigating the complex customs regulations around the world. Throughout 2024 we moved 1,500+ shipments to 36 different countries globally.

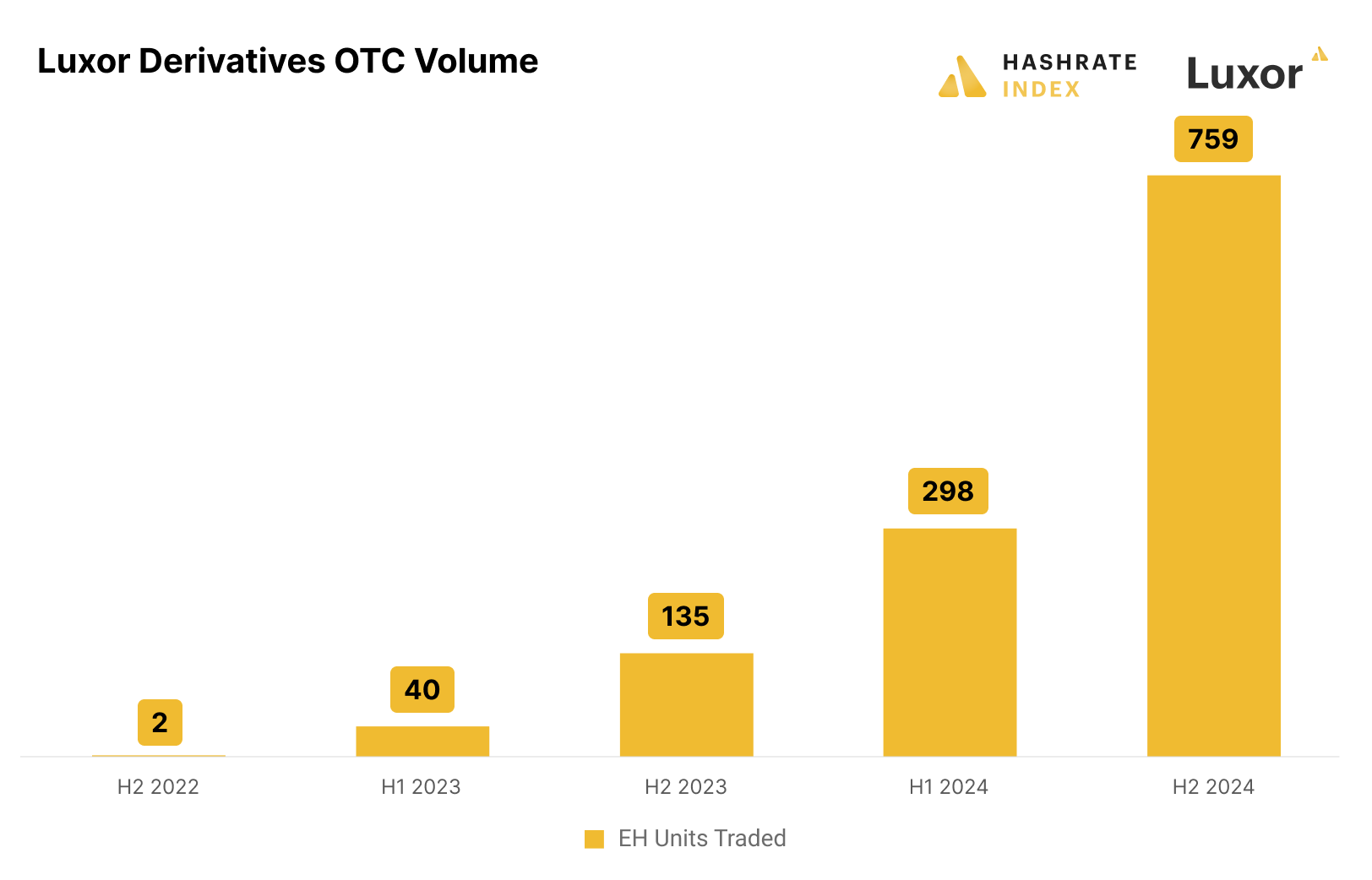

Hashrate Derivatives Growth Goes Exponential

The initial vision for the hashrate derivative product was to provide Bitcoin miners with a tool to hedge future revenue. While we have learned a lot in the journey and iterated on various potential use cases, it’s clear that miners are finding value in selling forward hashrate for non-dilutive financing, and also locking in their pool payments for a period of time.

In 2024, Luxor’s hashrate derivatives were used by public and private miners, prop trading funds, financiers, market makers, hosting providers, hashrate marketplaces, and ASIC brokers. Interest from miners and the trad-fi communities are at a record high to end the year. We have continued to expand on our product offering such as increasing tenures to 12 months in duration and launching hashrate exchange-traded futures.

On the business side, we onboarded 30 new clients into our markets and traded $65M in notional USD, settling about 1.2EH per day on average.

Mining Pool Finds a New Angle

In 2024 we launched v6 of our pool dashboard, a continuation of our commitment to take our users’ feedback and integrate it into product design. One area of focus has been on different roles and setting up permissions, which are very important for larger operations. We have furthered the integration of the pool with our hashrate derivatives (to get fixed payouts) and with LuxOS (to get reduced fees). We think the future of mining is to utilize the mining pool dashboard to actively manage revenue, whether it be through spot or future (locked) hashprice.

On the business side, our hashrate expanded to 24.1 EH/s by end of year, representing a growth of 43% in 2024. We mined ~1,200 Bitcoin blocks over the year, a total of 5,144 BTC and $315M+ equivalent in USD. At year end we had over 2,000 companies utilizing our pool services.

The mining pool space has become quite interesting with the emergence of Bitcoin native projects including ordinals/runes, various L2s, sidechains and more. Luxor is committed to maximizing revenue for our mining pool clients, and as such we want to continue to support healthy innovation on the Bitcoin blockchain that leads to higher transaction fees for miners.

While still early, we saw glimpses of what might be on the horizon in this respect. The first tranche of Babylon staking caused fees to spike over 1,000 sats/vByte. Runes (L1 UTXO-based fungible digital assets) caused hashprice to increase after the halving in April. Many of the L2/sidechains announced during the mania of H1 2024 are getting ready to launch in Q1 2025. There is still the looming discussion to fork Bitcoin to introduce OP_CAT, which will most likely continue to heat up in 2025. Mining pools are at the center of these innovations and Luxor is committed to being on the forefront.

The Data and Research Source: Hashrate Index

When we designed the plan to break into Bitcoin mining research in 2018 (launching shortly thereafter on Medium), our guiding idea was to provide a consistent mining industry source for readers. Since then, through Hashrate Index, Luxor has been the only company to consistently publish mining research and reports. We take insights from the trenches with miners and use them to drive unique, valuable insights on mining technologies and economics.

This year, we launched the new UI and website design for Hashrate Index (v3.0). We focused on improved navigation, chart features and a streamlined Rest API. We love building Hashrate Index starting with user feedback, and many of our recent improvements have been led by direct feedback from users.

We are excited about some of our new content initiatives introduced in 2024 such as the Hashrate Markets Lookback Series, Tx Fees Forecast + Lookback Series, and Firmware and Derivatives Strategy Analysis. In addition, we now host a monthly “Mining Metrics” podcast in partnership with Compass and a monthly X Spaces.

Sprinting into 2025

As with every year, we are excited to continue to build our existing product suite and bring novel features and products to the market. We plan to continue expanding our compatibility with LuxOS, breaking into new derivative offerings, and venturing into the broader generalized compute industry.

Our new energy desk is launching in early 2025. We plan to offer comprehensive portfolio management services specifically targeted toward large compute operators such as Bitcoin miners and datacenters.

Under the radar, we have been building a new cloud services product, which is almost ready to see daylight. We believe that Compute as a Commodity will become one of the world’s largest markets right alongside the growth in energy markets. In Bitcoin mining, a niche within the Compute market, Luxor has successfully built several business lines. Now, we’re ready to take our expertise into the broader Compute space. Stay tuned for more details!

Thanks again to all of our great partners for supporting us on this journey.

Happy Hashing, and Happy New Year!

-Luxor Tech Team